I had a busy week that included giving an invited speech at SUNY Geneseo on Friday night, then leading a brief research project for a group of students on Friday evening and all day Saturday. The students were fantastic, and it was a delightful but exhausting weekend. Today’s post is a little shorter due to all this. Now, on to the topic of today's post.

The International Energy Agency (IEA) publishes a monthly report on OECD (Organization for Economic Cooperation and Development) oil and gas production and consumption. The media can spotlight electric vehicle sales and net zero targets, but atmospheric CO2 is not going to decrease unless we reduce our usage of fossil fuels.

Figure 1 depicts crude oil, NGL, and refinery feedstocks, with a 6.0% increase from July 2022 to July 2023.

Total OECD indigenous production of crude oil, NGL and refinery feedstocks increased by 6.0% in July 2023 compared to July 2022. The trend was driven by increases in the OECD Americas (+6.6%, y-o-y1) and led primarily by the United States (+9.0%, y-o-y). OECD Asia Oceania and OCED Europe also experienced an upward trend in production, with year-on-year increases of 8.8% and 1.3% respectively. The main regional drivers of these trends were Australia (+10.4%, y-o-y), and Norway (+10.7%, y-o-y), despite being balanced out by a decrease in the United Kingdom (-18.2%, y-o-y). Overall, total OECD production increased by 5.7% on a year-to-date2 basis.

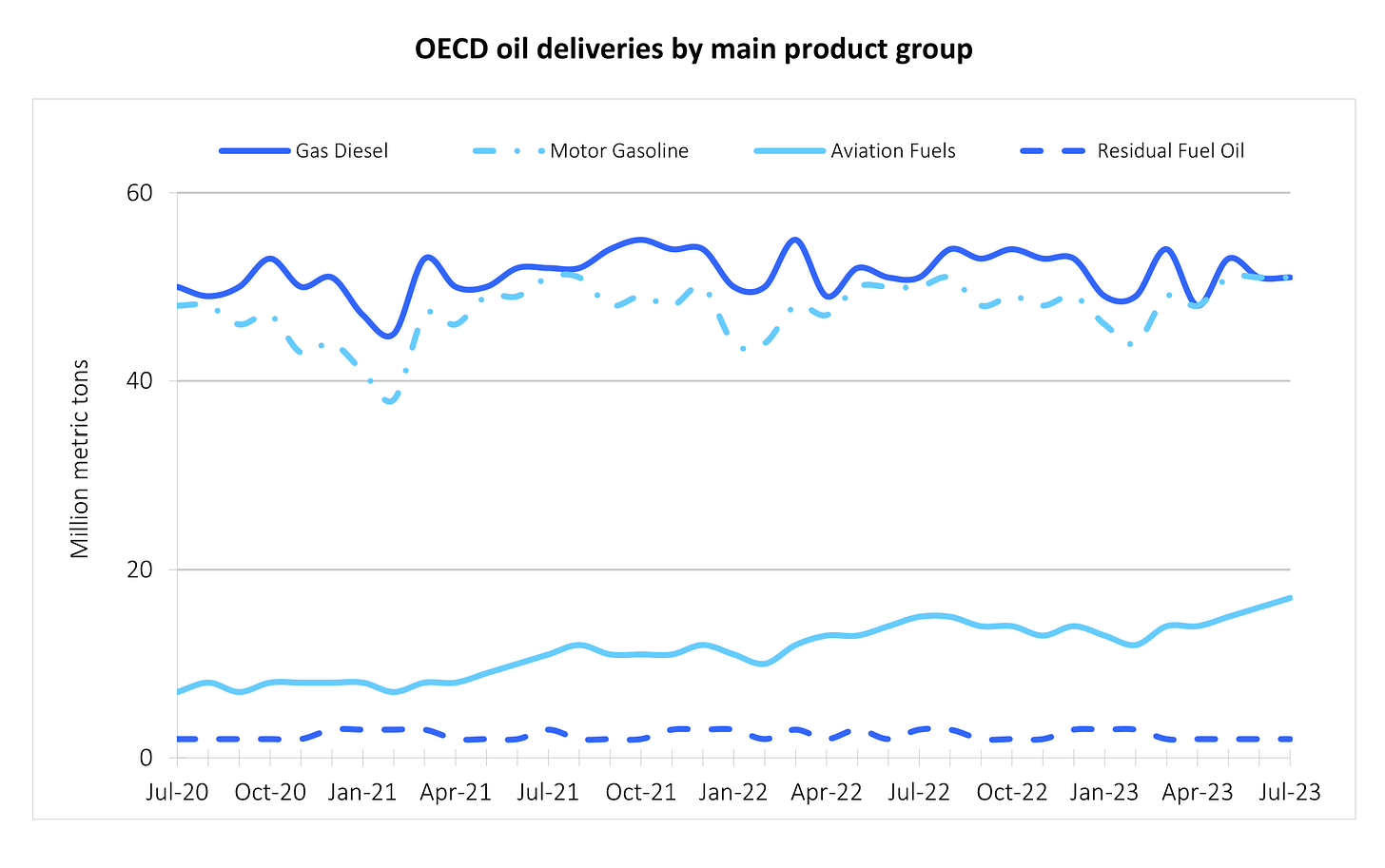

More noteworthy is where the increases in consumption occurred, as seen in Figure 2. Despite increased EV sales, gas diesel and motor gasoline trends are essentially steady; however, aviation fuels have a general upward tendency. Wealthy individuals, in general, fly. I noted this issue in CO2 emissions are an inequality problem:

This is yet another reason why I don't think much will change. The wealthy are uninterested in changing their lifestyles to lower their energy consumption. They may invest some money in electric cars or solar panels, but decreasing consumption is largely out of the question.

The increase in aviation fuels seen in Figure 2 is evidence that people aren’t interested in cutting down on air travel. Here is the IEA overview for oil deliveries.

Total OECD net deliveries of finished products decreased by 0.2% in July 2023 compared to July 2022, with a modest increase of 0.3% year-to-date. Naphtha (-15.1%, y-o-y) and other products (-9.4%, y-o-y) led the decrease, that was balanced out by increases in total kerosene (+13.1%, y-o-y) and total gasoline (+2.2%, y-o-y). Only the OECD Americas experienced a slight decrease for total products (-1.2%, y-o-y), whereas OECD Asia Oceania and OECD Europe underwent an increase in net deliveries (+1.1% and +0.9% y-o-y, respectively). The countries driving the trend for each region were the United States (-1.9% y-o-y), Australia (+5.6% y-o-y), Türkiye (+20.8%, y-o-y) and Germany (-8.8%, y-o-y).

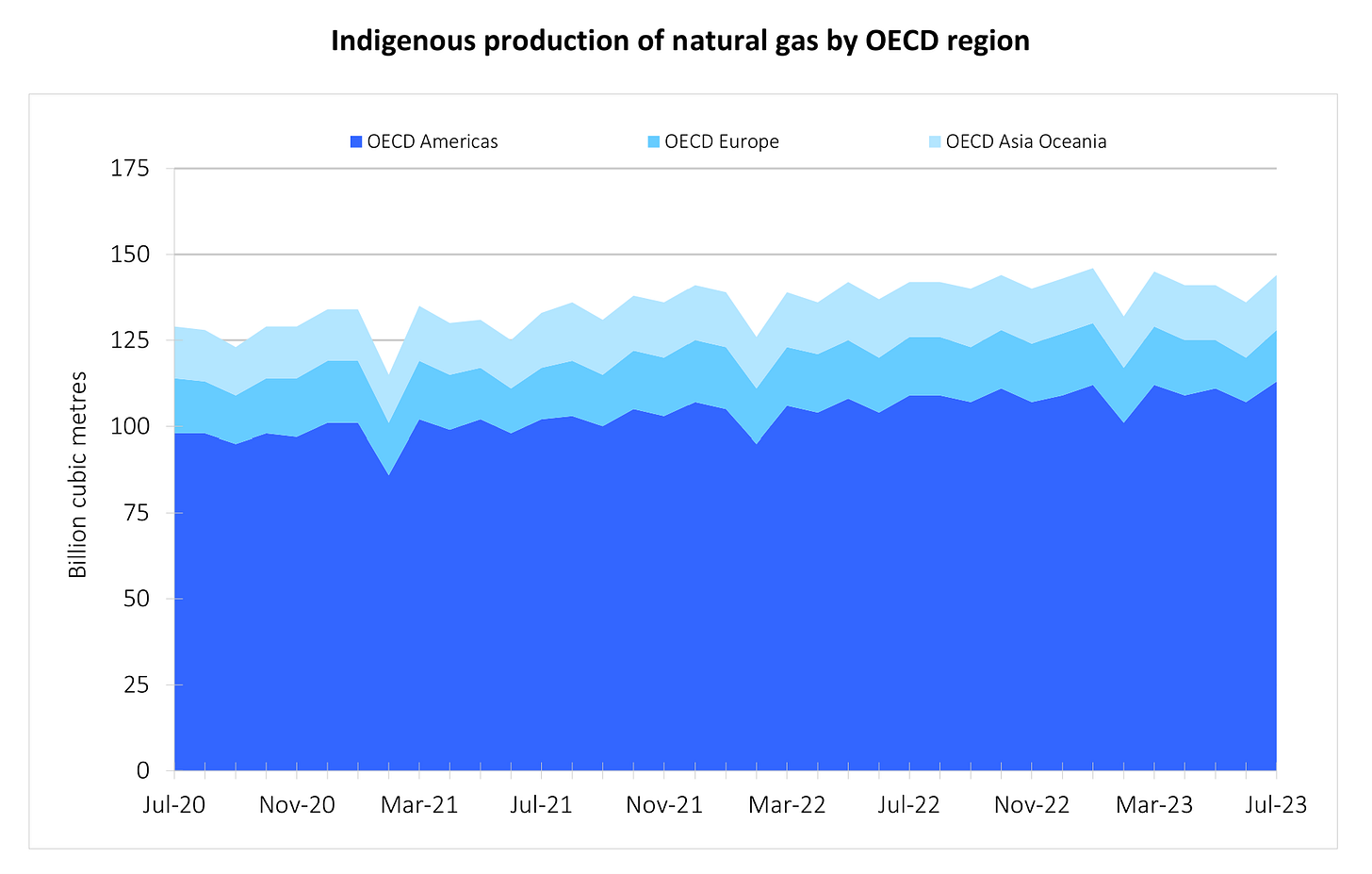

One more graph, Figure 3, shows natural gas production. Again, we see a general upward trend for the last three years. After the graph is the IEA commentary on natural gas production.

In July 2023, total OECD indigenous production of natural gas increased by 1.2% compared to the same month the previous year. This growth was primarily driven by the OECD Americas, where the United States playing a significant role, experiencing a 3.5% year-on-year1 increase in production. Canada also contributed to this growth with a 1.7% year-on-year rise. In contrast, indigenous natural gas production in OECD Europe witnessed a significant decline of 9.6% year-on-year, driven by substantial drops in Norway (-7.9% y-o-y) and the Netherlands (-29.1% y-o-y). Meanwhile, OECD Asia-Oceania experienced a slight decline of 0.5% year-on-year.

Conclusion

I couldn't find a monthly OECD coal report from the IEA. This is significant since switching from natural gas to coal reduces CO2 emissions. Still, we can say that all of the effort in EVs, solar, wind, and other renewables is likely slowing fossil fuel consumption, but we are still witnessing gains.

I said in last Thursday's Quick Takes that the EIA (same three letters, so for clarity: IEA, International Energy Agency; EIA, Energy Information Agency, which is a U.S. government agency) is expecting rising CO2 emissions until 2050, and so far we are still increasing oil and gas production. ExxonMobil's recent acquisition (10/11/2023) adds to the evidence:

SPRING and IRVING, Texas – Exxon Mobil Corporation (NYSE: XOM) and Pioneer Natural Resources (NYSE: PXD) jointly announced a definitive agreement for ExxonMobil to acquire Pioneer. The merger is an all-stock transaction valued at $59.5 billion, or $253 per share, based on ExxonMobil’s closing price on October 5, 2023. Under the terms of the agreement, Pioneer shareholders will receive 2.3234 shares of ExxonMobil for each Pioneer share at closing. The implied total enterprise value of the transaction, including net debt, is approximately $64.5 billion.

What does this $59.5 billion buy?

The merger combines Pioneer’s more than 850,000 net acres in the Midland Basin with ExxonMobil’s 570,000 net acres in the Delaware and Midland Basins, creating the industry’s leading high-quality undeveloped U.S. unconventional inventory position. Together, the companies will have an estimated 16 billion barrels of oil equivalent resource in the Permian. At close, ExxonMobil’s Permian production volume would more than double to 1.3 million barrels of oil equivalent per day (MOEBD), based on 2023 volumes, and is expected to increase to approximately 2 MOEBD in 2027. ExxonMobil believes the transaction represents an opportunity for even greater U.S. energy security by bringing the best technologies, operational excellence and financial capability to an important source of domestic supply, benefitting the American economy and its consumers.

Only a fool would believe that ExxonMobil isn’t going to pump all the oil it can out of the Permian. Clearly, they are betting on oil.

Please share and like

Please help me find readers by forwarding this article to your friends (and even those who aren't your friends), sharing this post on social media, and clicking like. If you're on Twitter, you can find me at BriefedByData. If you have any article ideas, feedback, or other views, please email me at briefedbydata@substack.com.

Thank you

In a crowded media market, it's hard to get people to read your work. I have a long way to go, and I want to say thank you to everyone who has helped me find and attract subscribers.

Disagreeing and using comments

I'd rather know the truth and understand the world than always be right. I'm not writing to upset or antagonize anyone on purpose, though I guess that could happen. I welcome dissent and disagreement in the comments. We all should be forced to articulate our viewpoints and change our minds when we need to, but we should also know that we can respectfully disagree and move on. So, if you think something said is wrong or misrepresented, then please share your viewpoint in the comments.