Is there a student load problem? The quick answer is that it's complicated, but it's not as bad as it's made out to be. To articulate my opinion, we must first go over some preliminary information and caveats. First, the data is from the College Scorecard of the United States Department of Education. I'm working with the Merged 2021–2022 data, which appears to be the most current full year. The information is provided for each college and includes the median debt of students in various categories. The Excel file is 6681 by 3232, so there is a lot more data than that. One important limitation is that there is no indicator for the distribution of data at each institution. For example, if the median loan debt for all students is $15,000, we have no data about the spread around that figure. More importantly, we have no idea how high this debt is for some students. Furthermore, because we don't have a mean, we can't compare the mean debt to the median to evaluate how skewed the data is.

As far as I can determine, the data is for students who have borrowed money. There are students who do not have any loans. Furthermore, the data only includes federal student loans and does not include any loans taken out by the parent, such as Parent Plus loans.

Today's overview will concentrate on undergraduate debt from universities that offer at least a bachelor's degree and have at least some in-person classes. A summary of community college and graduate programs will be posted in the future.

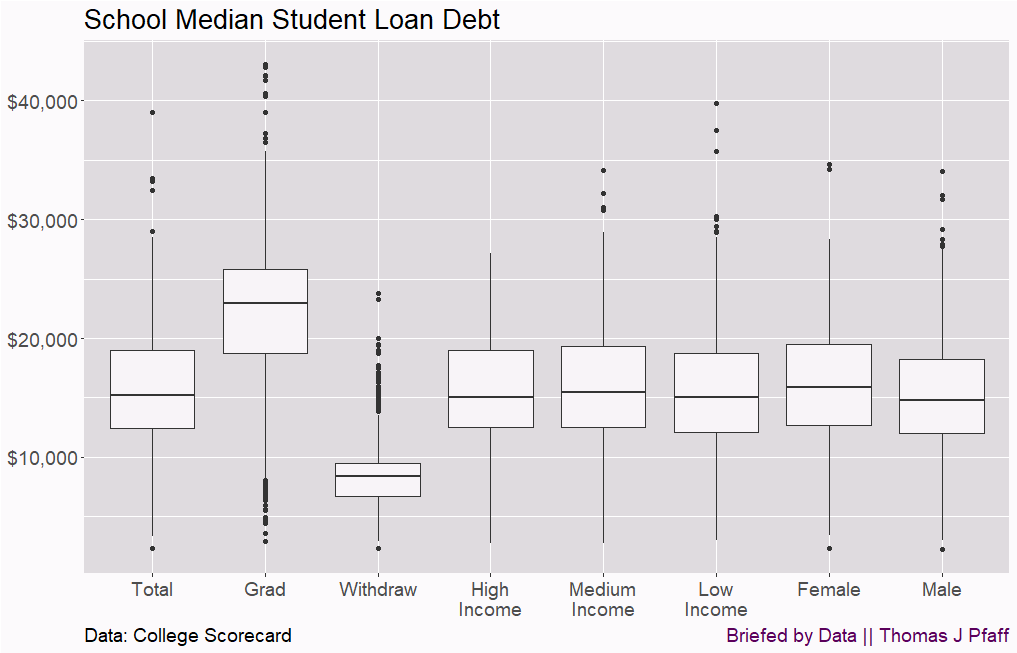

Figure 1 is my attempt to summarize the problem in a single graph. Remember that each data point in a boxplot represents the median debt of a cohort of students from a specific college. This can be a little perplexing. For example, the total cohort median is around $15,000. This means that of all the colleges we are looking at, the median college has a median loan debt of $15,000 for their students. Half of the colleges have higher median student debt, while the other half have lower debt. Remember that the 25% and 75% cutoffs are the ends of the boxes in a box plot, with the median line in the middle.

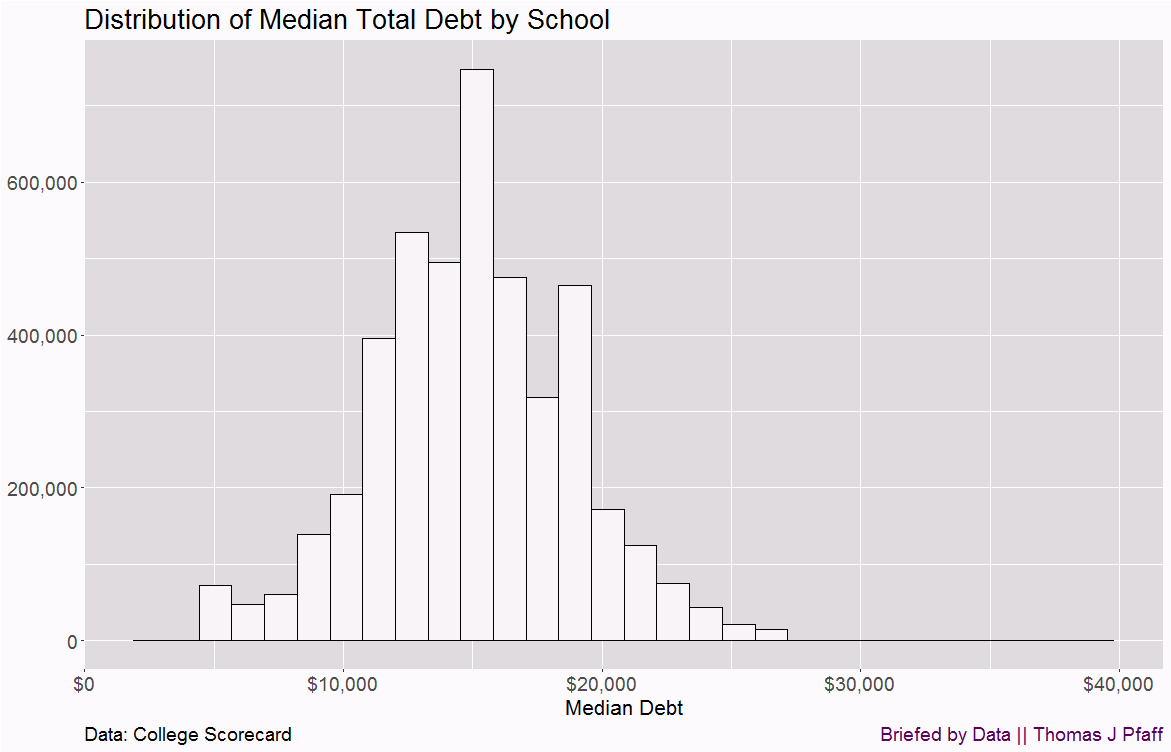

The boxplots allow us to compare various student cohort groups. A distribution of just the total is given in Figure 2. I included this so that we can compare the boxplot to a histogram. One question I need to answer is that each data point in Figures 1 and 2 represents a college cohort, but these cohorts are unlikely to be, and in fact aren't, the same size for each school. This could be misleading because the points in Figure 1 at the high and low ends may reflect very few or many students. To investigate this, I created a graph similar to Figure 1 but weighted each college depending on the number of students in the loan cohort group. This is Figure 3, and there isn't much of a difference between it and Figure 1.

Note that in Figure 3, I removed a few very large colleges from the data, such as the University of Phoenix. Another peculiarity of the data is that it is aggregated from some college systems. For example, all data from all University of Phoenix locations is reported as one. All of the colleges I excluded from Figure 3 but not from Figure 1 had low median student loan debt.

Now that we have some of the preliminary information out of the way, let’s talk about the results presented in Figure 1.

Total

To make it easy to reference, I've included Figure 1 again below.

The total boxplot indicates the student's loan balance when they began repayment. A student may or may not have graduated from college. As far as I can determine, the student in this scenario is also linked to the college they last attended. The total category is misleading because it includes students who graduated and those who did not. Students who did not graduate, in particular, spent fewer years in college and generally have less debt.

Still, the medians here aren’t’ outrageous. More than 75% of colleges have students with debts of less than $20,000. We can be positive that half of the students in 75% of universities have debt of less than $20,000, or around 37.5% of students. Now, the 37.5% is likely much higher because if the median at a college is $15,000, there likely aren't many students with loan debt greater than $20,000. Nonetheless, the lack of information related to the spread is frustrating.

I'd wager that the majority of students have less than $20,000 in student debt. Having said that, we do have a cluster of universities with median debt exceeding $25,000 and a couple at the $30,000 level. Is this an issue? What the students received in return for their investment might determine it. The top eight colleges in terms of median debt are listed below. Are these universities worthwhile? I'm not sure, but they also don't represent a large number of pupils.

Grad

This category indicates the median debt of graduates. It makes sense that this is overall higher than the total, and it still isn’t that bad. Most students appear to be under $30,000 in debt. Again, we must stress that we know nothing about spread. One could spend $30,000 on a car, and investing that in a college education would seem to be a fair alternative. Another caveat would be what the students got for the $30,000, but that is at least partly their responsibility. If one is motivated to learn, one can learn a lot at most colleges. We do have some high-debt colleges here, so let me list a few of them.

It is relevant to note that Strayer University is a for-profit college with several locations and online options. Because all sites are pooled under the DC location, the number of students is so large.

I'd also like to highlight some of the colleges on the lower end of the debt scale. It is worth noting that this list of universities is not particularly noteworthy in terms of ranking or reputation, but they are keeping debt low and deserve to be mentioned.

Withdraw

These are students who did not graduate and who owed money. Now, spending $10,000 to discover that college isn't for you isn't terrible, but when the median rises to $15,000 to $20,000, indicating that there are students with higher debt, I have some concerns. Who are some of these universities? Here you go.

I believe that institutions bear some responsibility for not allowing students to continue to incur debt if they are not performing well in college. This is easier said than done, but it shouldn't be overlooked.

Income

For low, middle, and high-income families, the income categories are $0-$30,000, $30,001-$75,000, and $75,000, respectively. I was pleased to learn that the median debt by school was around the same for all three groups. Higher education has a history of having students who can afford to pay more, paying more, and then using those funds to finance more grants for students with limited financial resources. The similarities in debt across these three categories indicate that this is happening. The income categories, on the other hand, are similar to the total category in that they contain both graduates and withdrawals. Is it feasible that the low-income group has more withdrawals than the other categories? Yes, possible, and likely, but the data isn’t broken down that way to prove this one way or the other. The top 14 low-income median debt colleges are listed below.

For-profit colleges Platt and Schiller are two of the top three colleges on the list. Are they worth the debt for a low-income student? Perhaps, perhaps not. The American University of Health Sciences, on the other hand, focuses on specific occupations, such as nursing, which may make the debt more worthwhile.

Female vs. male

I added this comparison since I was surprised to find a difference, with males having less debt. Keep in mind that females are the majority on campus and have been for decades. At first, I thought that institutions were offering more money to recruit male students behind the scenes, and maybe this is happening. In reality, the explanation is probably because guys drop out of college at a higher rate than females. This would reduce their overall debt.

Concluding thoughts

Overall, the median debt by college is not alarmingly large or plainly indicative of a crisis of any kind. Still, there are certain concerns and colleges with high median debt, as well as cohorts with high median debt, such as students who dropped out of college. The actual question is, "Is the debt worth it?" There is a lot of ambiguity here, and there is no obvious answer. Two students could have the same, say, $25,000 debt, and one would find it worthwhile while the other would not.

I think the bigger problem here is not the debt so much as the marketing, misguidedness, and incentives. Colleges have touted the completion of college as a guarantee of higher-paying jobs. This is the ROI argument. The issue is that this is not correct. College is currently a chance that may or may not pay off (I believe there are other reasons to attend college outside of return on investment, but I'll focus on that here). Students appear to have bought into this idea, with some or many believing that all you have to do is graduate. They don't appear to understand how important their effort and motivation are. They then appear startled when their college diploma does not result in a six-figure career and are angry about their debt and college in general.

The incentive for colleges is to keep students on campus for as long as possible. When a college talks about student achievement, it usually refers to graduating. This is one aspect that contributes to grade inflation and lower standards, as colleges don't want students to fail out even if they aren't working particularly hard. Many "weeder" courses have died as a result of this. These were usually difficult courses that students had to take in order to "fail out" those who couldn't "hack" college. On the one hand, these classes appear cruel and unnecessary. On the other side, where we are currently is to make earlier courses easier so that students do not drop out. The issue here is that students are being moved forward when it may be better for them to discover early on that college is not for them.

There are other student debt issues to investigate. I need to consider both graduate schools and community colleges. There are questions about the outcomes as they relate to debt, as well as questions about the types of colleges with higher or lower debt. There will be more on this in the future.

Please share and like

Please help me find readers by forwarding this article to your friends (and even those who aren't your friends), sharing this post on social media, and clicking like. If you're on Twitter, you can find me at BriefedByData. If you have any article ideas, feedback, or other views, please email me at briefedbydata@substack.com.

Thank you

In a crowded media market, it's hard to get people to read your work. I have a long way to go, and I want to say thank you to everyone who has helped me find and attract subscribers.

Disagreeing and using comments

I'd rather know the truth and understand the world than always be right. I'm not writing to upset or antagonize anyone on purpose, though I guess that could happen. I welcome dissent and disagreement in the comments. We all should be forced to articulate our viewpoints and change our minds when we need to, but we should also know that we can respectfully disagree and move on. So, if you think something said is wrong or misrepresented, then please share your viewpoint in the comments.