Minerals for renewables

Follow the copper

I was thinking about the offshore wind item from Thursday's Quick Takes post (copied here at the end) when I recalled the issue of minerals utilized in various energy sources. Figure 1 depicts minerals in kg/MW by energy type. If you remember Data Rule 4: Normalize properly; ask, "Per what?" the units are fine, but keep in mind that this is installed MW, not lifetime MW. I would prefer some form of lifetime MW generation, but what we have is still useful. Figure 1 is the same graph as in the IEA paper The Role of Critical Minerals in Clean Energy Transitions, but the minerals have been reordered to make comparison simpler.

A few things stand out. The first is the amount of minerals utilized for offshore wind, which is 50% more than for the next category, onshore wind. The second factor is the importance of copper in all energy sources. Figure 2 shows the copper price from FRED. Prior to 2004, the price remained below 3,000 per metric ton, and it has climbed around four to five times since then.

The other thing worth noting is that China is the main producer and processor of copper, as seen in Figure 3.

I'm not saying this is what's causing problems for offshore wind, but given how much copper offshore wind requires, it can't help. All of this is worth noting, as offshore wind is a potentially challenging energy source to scale up.

Here is the post from Quick Takes about offshore wind.

Offshore wind has headwinds

From the Bloomberg article Soaring Costs Stress US Offshore Wind Companies, Ruin Margins (8/1/2023)

The US offshore wind industry faces a perfect storm of rising costs, permitting delays and grid connection hurdles – all leading to low returns. Inflation and supply chain challenges have driven up capital expenditure, while financing costs have spiraled due to rising interest rates. Developers want to renegotiate their previously-agreed offtake deals which are no longer profitable while some are trying to cancel their contracts altogether.

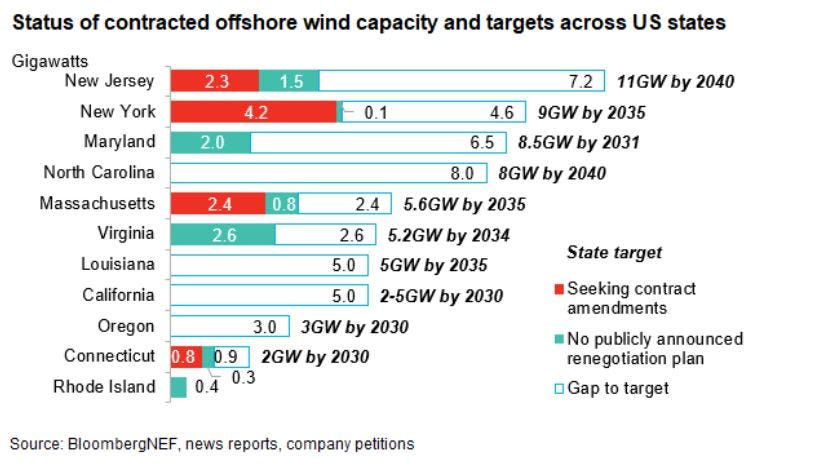

and an interesting graph with a related quote

Several US states face a growing risk of missing their offshore wind goals. New York state has a target to add 9GW of cumulative offshore wind capacity by 2035 and has contracted 4.3GW of projects in its two solicitations so far. Developers of 95% of the contracted capacity are now trying to renegotiate their contracts, putting the projects at risk of delays. In Massachusetts, developers of 75% of contracted capacity are looking to renegotiate or cancel their offtake deals. In Connecticut, 73% of the contracted pipeline is at risk and in New Jersey, which is targeting 11GW by 2040, 60% of its contracted pipeline is at risk of delays.

It is hard to read all of this and not think that offshore wind energy isn’t as cheap as touted. I’ll keep saying it. Climate change is real and a problem, but the reality is that the 1.5°C target is not happening, and 2.0°C is probably a long shot. This doesn’t mean we shouldn’t continue to try to reduce CO2, even aggressively, but we also have to focus on adaptation. This is an AND statement, not an OR statement.

Please share and like

Please help me find readers by forwarding this article to your friends (and even those who aren't your friends), sharing this post on social media, and clicking like. If you're on Twitter, you can find me at BriefedByData. If you have any article ideas, feedback, or other views, please email me at briefedbydata@substack.com.

Thank you

In a crowded media market, it's hard to get people to read your work. I have a long way to go, and I want to say thank you to everyone who has helped me find and attract subscribers.

Disagreeing and using comments

I'd rather know the truth and understand the world than always be right. I'm not writing to upset or antagonize anyone on purpose, though I guess that could happen. I welcome dissent and disagreement in the comments. We all should be forced to articulate our viewpoints and change our minds when we need to, but we should also know that we can respectfully disagree and move on. So, if you think something said is wrong or misrepresented, then please share your viewpoint in the comments.