As I see it…

It’s normal for human beings to complain about work-related issues. In higher education, one of the forms this takes is complaining about students, both their behaviors and preparation for college. This complaining is misdirected.

As I see it, student behavior is learned throughout K-12. If a student is doing something that doesn’t make sense, they are likely doing it because it has worked for them or their friends in the past. If they don’t do the readings or other homework, it is likely because they have passed classes without doing it. If they are requesting a grade adjustment, it probably worked for them or someone they know in the past. They graduated from high school and were accepted into college, and they will continue their behaviors until they consistently fail to pass courses, not just in one class but across all of them.

A new trend we are observing is that students are applying for and being accepted into majors for which they are vastly unprepared. Specifically, we are observing that students are enrolling in majors requiring a significant amount of math, such as physics, mathematics, and finance, while their placement scores indicate they need remedial math. These are small gaps; they are large gaps.

This scenario makes little sense to me. Generally students are good at selecting majors that more closely match their skills and preparation. In my opinion, what is likely happening is that someone in high school is advising or encouraging students to select these majors. I suspect this phenomenon is one of the outcomes of grade inflation and low expectations. In some cases, they might catch up and do fine, but generally they don’t. Ultimately the situation is detrimental for these students. They can spend multiple semesters working toward a degree while either having to take courses over because of insufficient grades or, with our own grade inflation problems, getting passed along and graduating without the skills the major is supposed to instill. They won’t be able to get a related job and would have been better off in a different major. To me, all this is a sign of a broken educational system.

Please, let me know your thoughts and experience related to K-12, expectations, and students getting into majors that match their skills and interests.

Let’s go to some data.

More on math from Gallup

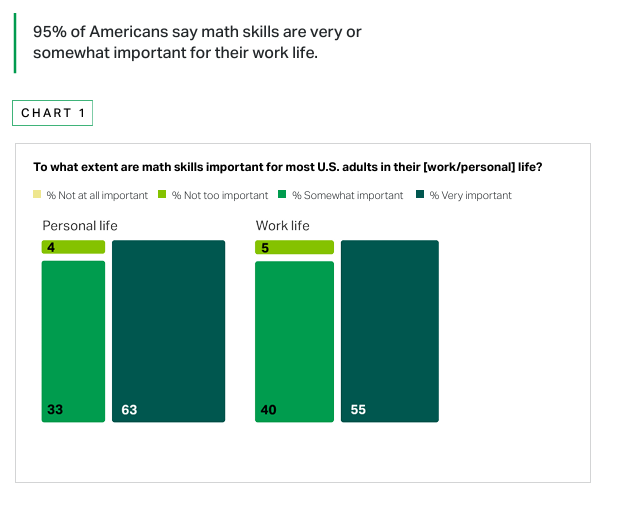

While we are discussing math, Gallup has released a recent report titled “Math Matters Study: The Value of Math in Work and Life,” which is based on the results of a survey conducted in December 2024. There seems to be a disconnect between what math students are learning or not and the value or importance of math, according to the survey.

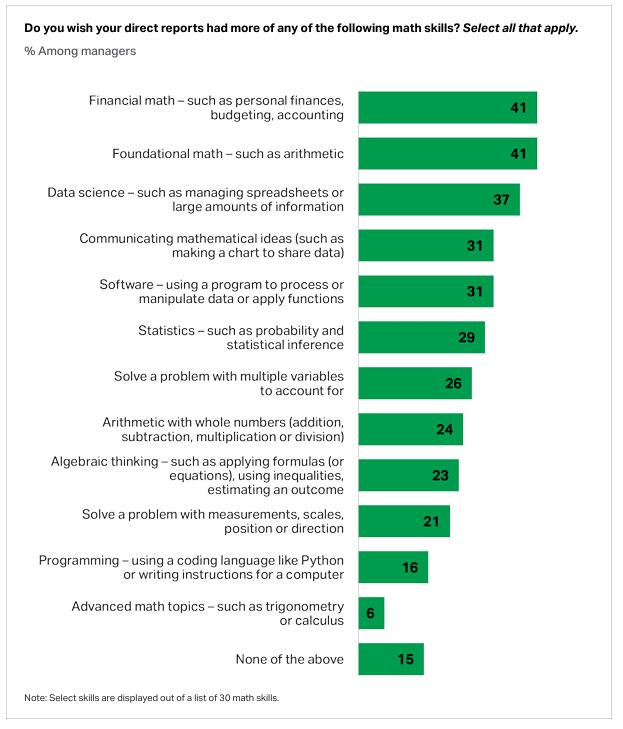

Before my math teachers get too excited, part of the disconnect is due to what people see as important and what we are teaching. We teach a lot of algebra and calculus; math faculty will talk about the beauty of math. Meanwhile, here is what managers wish workers had.

For those in college math departments, you need to start bridging the gap between what you want to teach and what people want you to teach or risk becoming irrelevant. I’d recommend creating a new major called Quantitative Problem Solving. This last graph is a perfect outline for the curriculum. I’m available as a consultant for a reasonable fee.

Global energy investments

Bet on hearing in the media how 2025 will be a record year for global clean energy investment. It is a true statement based on the iea’s World Energy Investment 2025 report. But, you knew a but was coming, this doesn’t mean we aren’t investing in fossil fuels. The key graph is below and interactive on the iea website.

In the clean energy bar on the far right, only the yellow, renewable power represents energy generation. The other colors represent energy efficiency, low-emission fuels, nuclear and other clean power, and grids and storage.

Currently, the yellow bar represents an investment of $780 billion USD. The stacked bar on the left represents fossil fuel investments, specifically $535 billion USD for oil, $365 billion USD for gas, and $248 billion USD for coal. This means that fossil fuel investments total $1,148 billion USD, while renewable power investments amount to $780 billion USD, or 1.5 times the investment in fossil fuels compared to renewable power.

So, yes, renewable power investment is up, from $760 billion USD, but we are still investing more in fossil fuels. I’m not sure I’d call this a green energy revolution, at least not yet.

Electric vehicle report

First quarter 2025 numbers are in, and sales of cars you plug in remain flat. From the eia:

For the last year or two, only hybrid electric car sales have grown. I’m not sure the U.S. is excited about having to plug in a car.

Voters aren’t going to spend to stop climate change

The graph here comes from the AEI Data Points newsletter, which doesn’t have a weblink. The AEI Data Points newsletter provides a link to a Free Press article that contains the data, which in turn references another article stating that the data will be released in December. The Free Press's handling of the data is rather sloppy, as they should link directly to the YouGov poll. I’ll assume the data is accurate.

Note that 47% of voters are willing to chip in a whole $1 a month to protect the climate. I’m not sure I would argue that voters still have a strong desire for fossil fuels; rather, it seems to reflect their disposable income. According to Google, approximately 57% of the U.S. population faces financial hardship. They don’t have extra cash. This data would be more insightful if it were broken down by income category. Still, by and large, when it comes to protecting the climate, most people aren’t going to put much money where their mouth is.

Data centers controlling energy sources

Meta signs 20-year PPA with Constellation for entire output of Illinois nuclear power plant (6/3/2025).

Data centers are so profitable that companies are essentially purchasing energy infrastructure. Essentially, Meta has acquired a nuclear power plant that it will own for the next 20 years. The free market at its best, I suppose, but should this concern us?

The spinning CD

Please share and like

Sharing and liking posts attracts new readers and boosts algorithm performance. I appreciate everything you do to support Briefed by Data.

Comments

Please tell me if you believe I expressed something incorrectly or misinterpreted the data. I'd rather know the truth and understand the world than be correct. I welcome comments and disagreement. I encourage you to share article ideas, feedback, or any other thoughts at briefedbydata@substack.com.

Bio

I am a tenured mathematics professor at Ithaca College (PhD in Math: Stochastic Processes, MS in Applied Statistics, MS in Math, BS in Math, BS in Exercise Science), and I consider myself an accidental academic (opinions are my own). I'm a gardener, drummer, rower, runner, inline skater, 46er, and R user. I’ve written the textbooks “R for College Mathematics and Statistics” and “Applied Calculus with R.” I welcome any collaborations.