As I see it…

One of the terms I really dislike is data-driven. That might surprise you given how much I present data, but data has its limitations. Data-informed is a much better term, as being briefed by data (clever, right?) can help in decision-making, but it shouldn’t be the only information used. One good example of the limitation of data is given by MLB manager Joe Maddon in the Athletic article Joe Maddon thinks Major League Baseball has issues. You might find them relatable. (4/16/2025)

All these numbers are based on large sample sizes, and I understand that. To me, a large sample size is pretty much infallible when it comes down to acquisitions in the offseason. But it is fallible when it comes down to trends in the moment.

So when you’re talking about how to set my defense on August 15, or how to pitch somebody on August 15, I need something more immediate and not just a large sample size. What is he like right now? Has he changed? Has he lost his confidence, or is he more confident than he’s ever been? There are fluctuations with people. That’s my problem: It bothers me that coaches, managers, whoever are not permitted to use their years of experience to make adjustments in the moment based on what they see.

As I see it, Maddon is making a key point about data-informed decision-making. The large sample sizes, which are used to make offseason decisions, are based on means, and means will likely play out over the course of a season. On the other hand, means don’t tell us about day-to-day variation that he points out in the example of setting his defense on August 15. His list of questions aims to address this daily variation, emphasizing the importance of incorporating years of experience and observations into decision-making.

There is a second point that he also might be making, which is that data, by its nature, is historical information, and the future won’t always follow historical precedent. In the case of baseball, players look to improve skills in the offseason to get better as well as age, which at some point doesn’t help. In general, data that is trying to predict human behavior is limited by the fact that people change and adapt.

We must always consider the data's purpose and limitations. Be data-informed, get your briefing, but don’t ignore other information.

As a related aside, one of my other terms I can’t stand is “best practices.” I regularly hear we are making some change, usually by a less-than-competent bureaucrat, to conform to best practices. What I hear is that someone figured out the current best way to do something and that we need to catch up. By the time we implement this best practice, it may no longer be a best practice due to changes in the world. If your organization is constantly implementing best practices, you might ask why you aren’t setting best practices for someone else to follow.

Let’s go to some data.

The importance of Greenland

Greenland is second in rare earth oxides reserves, a key resource for renewables and other technology. The post Hidden Wealth: Nations Sitting on Trillions (4/29/2025) has other facts about rare earth oxides by country. Also note how little the U.S. has compared to the top five countries.

Living at home

Pew informs us (4/17/2025) that the percent of young adults, 25-34, living with parents is down to 18% after a pandemic peak. This is a good example where a mean is useful information, but we also want to know more about the distribution (Data rule: Know the distribution, not just the mean and median.) Thankfully, Pew includes this map.

The cutoffs here are a little deceiving, as <14% has a lot of variation. In fact, there are cities as low as 3%. Ithaca, NY, is one of them.

Renewable challenges

A worthwhile 5 minutes from Peter Zeihan. (5/1/2025) My key takeaway: Due to the retirement of about 2/3 of boomers, their money has shifted to safer investments, resulting in a decrease in overall money availability. This trend has increased the cost of financing by a factor of 4 over the last 5 years, and in turn has hurt solar and wind. Why?

For example, 1/5 of operating a coal plant is the upfront cost of building it, with about 2/3 buying coal over the lifetime of the plant. Solar and wind, on the other hand, require about 2/3 of the lifetime cost up front to build them. With financing being more expensive, it is more challenging to get wind and solar projects built.

There are other factors, including increased tariffs on China.

The cost of student loans to taxpayers

Once projected to turn a profit, the Congressional Budget Office expects federal student loans to cost taxpayers another $193 billion over the next decade. The CBO issued those projections in June 2024, before the abysmal state of student loan repayment came to light. The agency’s next round of projections will probably be even gloomier.

This is from the Washington Post opinion piece The student loan bubble is about to pop (4/28/2025). It made sense to me to pause student loan payments during the pandemic even though it was a gift, with a $238 billion price tag, to those that went to college, while many of those that had to work didn’t go to college and didn’t get such a gift. However, the pause should not have lasted five years, and it appears some borrowers have forgotten their loans.

In February 2020, the last month before the government paused payments, 60 percent of Nelnet’s borrowers were repaying their debts. Five years later, payments are due again — but the repayment rate has fallen to 38 percent.

I’m not opposed to the student loan program, but maybe it needs a little rethinking. For example, how much should the taxpayer help someone go to law school? To what extent do undergraduate loans serve as subsidies to colleges, and does this potentially incentivize them to raise the cost of attendance? It's easy to understand why the working class, or those who don't attend college, might not be enthusiastic about bearing the burden of delinquent loan repayment.

On ticks

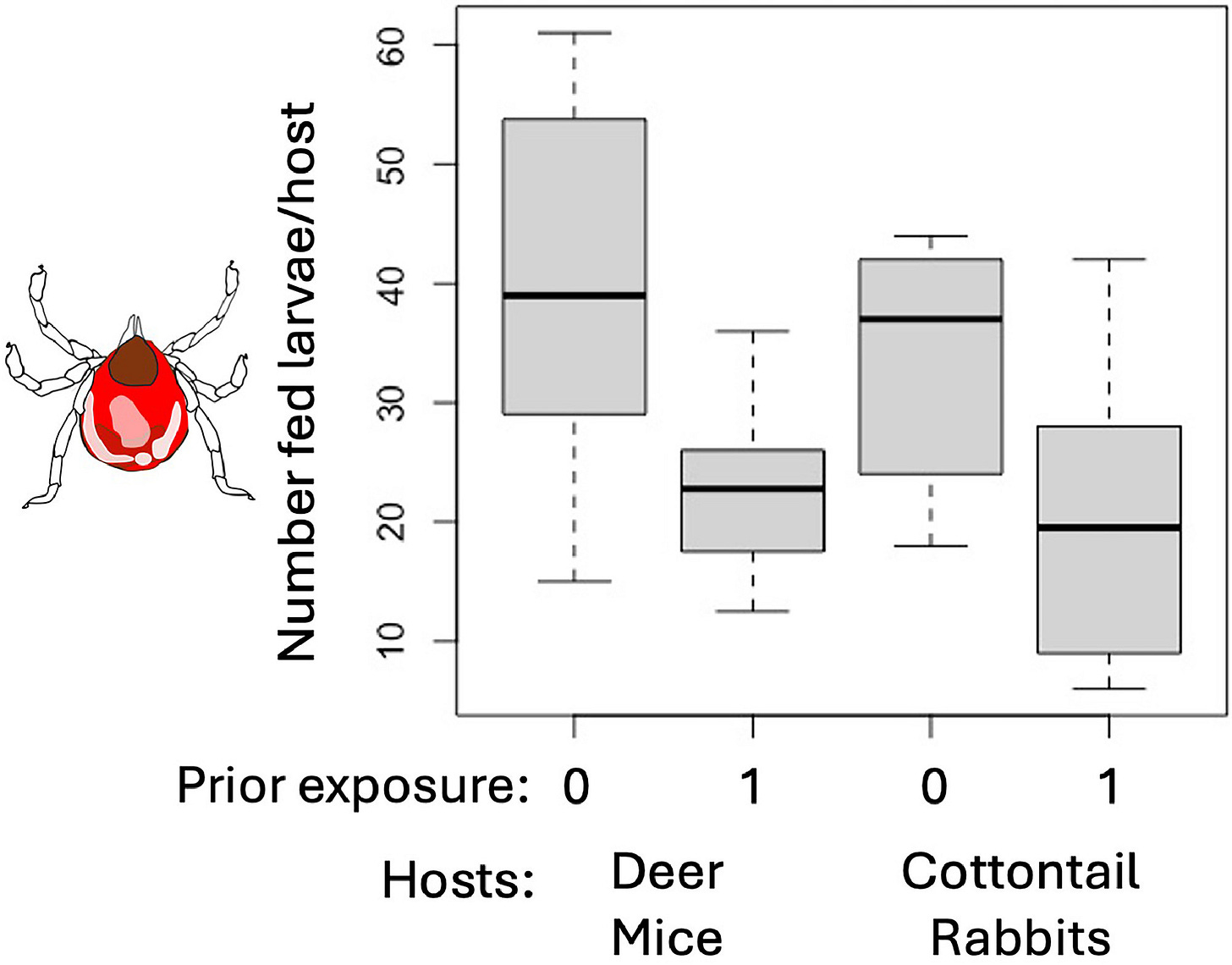

It appears that some animals—mouses and rabbits anyway— develop a certain resistance to or ability to deal with ticks after being bitten. This come from the paper Linked empirical studies reveal the cumulative impact of acquired tick resistance across the tick life cycle. (May 2025)

Caption:

Fig. 3. Boxplot of fed larvae recovered from simultaneous infestations of Deer mice (P. maniculatus) and Cottontail rabbits (Sylvilagus nuttallii) that had 0 or 1 prior infestation. All animals were infested with 100 unfed larvae. Host animals were able to groom and could kill or consume ticks. Fewer fed larvae were recovered after feeding on a host with prior tick exposure (βexposed = −0.77, SE = 0.37, z = −2.08, P = 0.038).

U.S. nuclear plants

From the eia (4/24/2025). Now you know both that the U.S. has the most nuclear power and where the plants are located.

Data center news

The spinning CD

Please share and like

Sharing and liking posts attracts new readers and boosts algorithm performance. I appreciate everything you do to support Briefed by Data.

Comments

Please let me know if you believe I expressed something incorrectly or misinterpreted the data. I'd rather know the truth and understand the world than be correct. I welcome comments and disagreement. We should all be forced to express our opinions and change our minds, but we should also know how to respectfully disagree and move on. Send me article ideas, feedback, or other thoughts at briefedbydata@substack.com.

Bio

I am a tenured mathematics professor at Ithaca College (PhD in Math: Stochastic Processes, MS in Applied Statistics, MS in Math, BS in Math, BS in Exercise Science), and I consider myself an accidental academic (opinions are my own). I'm a gardener, drummer, rower, runner, inline skater, 46er, and R user. I’ve written the textbooks “R for College Mathematics and Statistics” and “Applied Calculus with R.” I welcome any collaborations.

I've just started re-reading Jean-Baptiste Fressoz's "More and More and More". He points out the the very framing of "energy transition" is badly flawed.

In reality, we add new energy sources to old while continuing to increase our use of the old. The framing of energy history as one of "transitions" from wood to coal to oil is yet another "just-so" story.

In "The Price is Wrong," Brett Christophers shows that renewables to date are unprofitable, and therefore uninvestable, without some kind of subsidy. Taxpayer subsidies are paying for someone's profit.