So far, I've discussed undergraduate debt and master’s degree debt, and now comes the Ph.D. version, but first a recap. There are some concerns about some of the outliers in undergraduate debt; for example, there are schools with a median debt of $20,000 for students who did not complete their studies, but generally, undegraduate debt is not prohibitive.

Here was my main takeaway for the master’s degree debt:

In some circumstances, students incur significant debt that is questionable. Is this a problem? I’m going to lean on the side of no. I'm concerned about 18-year-olds incurring too much debt to attend college since they may not understand the consequences. Students entering graduate school, on the other hand, are at least 22 years old and have completed an undergraduate degree. I have less sympathy for them if they make bad financial decisions, and some of the big debt you'll see here was not necessarily a bad financial decision.

I'm somewhat concerned about the data for the Ph.D. edition here. The data comes from the College Scorecard of the United States Department of Education. As with master’s degree data, I’m using data from the Field of Study data files. I'll provide the median debt per degree type, although, as you can see below, some degrees, such as a Ph.D. in mathematics, are absent from the data. I'll post in another category, professional, and it's possible that some of these were moved there or that the data was not filed. Another possibility is that the median debt is zero or near zero for some of these Ph.D.'s, and with very few students with any debt, the data would be hidden to protect people's information.

I've prepared four charts below based on the number of students represented in the given programs. The data is not organized by school but rather by program from all schools. There are some programs that are so small that this information cannot and should not be posted because people can be identified or nearly identified. The cohort consists of students who finished their Ph.D. during the 2018–2019 or 2019–2020 school year.

The debt is for debt incurred while attending college for the Ph.D. This makes comparisons difficult. In rare situations, a student may obtain a master's degree at one institution and a Ph.D. at another. Others may pursue a Ph.D. at the same institution after completing their undergraduate degree. The first case would probably have less debt. We also don't know how much undergraduate debt was incurred; however, the college scorecard is working to collect cumulative debt. The concern here is that there may be a bias in who attends graduate school. Is a student with little undergraduate debt more likely to attend graduate school?

Even with these limitations, we can make some general observations. There are obviously some programs in which students appear to be incurring significant debt, which does not necessarily make sense to me in terms of return on investment. For example, a psychology degree (other) has a median debt of more than $200,000, while religious studies programs have about the same amount. On the other hand, I'm not going to call this a student debt crisis because these are students who are mature enough to make decisions. They already hold an undergraduate degree and possibly a master's degree. They could stop there and probably be fine in life.

Another major conclusion is that graduate degrees are increasing overall debt. For example, a fast Google search will yield several versions of Figure 1. I got this one from the Education Data Initiative. First and foremost, if someone uses a graph like this, do not take them seriously. At the very least, this should be done per capita. Even if this is done, it must be done at the degree level. As shown here below, some Ph.D. students are incurring significant debt.

On the other hand, some of the debt concerns me. As a society, I would say that we want people to pursue advanced degrees to help continue advancing human knowledge. If the cost and debt become prohibitively expensive, the best students may calculate the return on investment and decide not to continue their study. This would leave us with just the wealthiest and not necessarily the best students pursuing postgraduate degrees. I don't have a great answer here, and I don't necessarily want taxes to finance advanced degrees, as it would likely create bad incentives for institutions and students.

Let's go to the data. There are four graphs since the data set contained 41 programs, and I was able to depict them on four graphs, the final of which included 11 programs. Following the division by the total number of pupils, each figure separates the programs alphabetically. The number of students in each program is displayed at the bottom of each bar.

Ph.D. programs with over 343 students

Figure 2 shows the largest programs. A median of roughly $60,000 is acceptable to me, the cost of an expensive car, depending on how much debt was accrued before the Ph.D. program. I believe that the $86,192 for a business degree is more likely to yield a return on investment than the $60,178 for a music degree, though. Keep in mind that these are medians, which means that around 50% of the students are above and the rest are below.

Ph.D. programs with 100 to 300 students

Figure 3 depicts what I call medium-sized programs. I'm not sure what psychology (other) implies, but over $200,000 in median debt seems excessive. There are four programs that have exceeded the $100,000 milestone, and three more are close. Is $111,318 for an HR Ph.D. truly worthwhile? The majority of the debt here appears to be excessively high. If anyone has any insights, please share them in the comments.

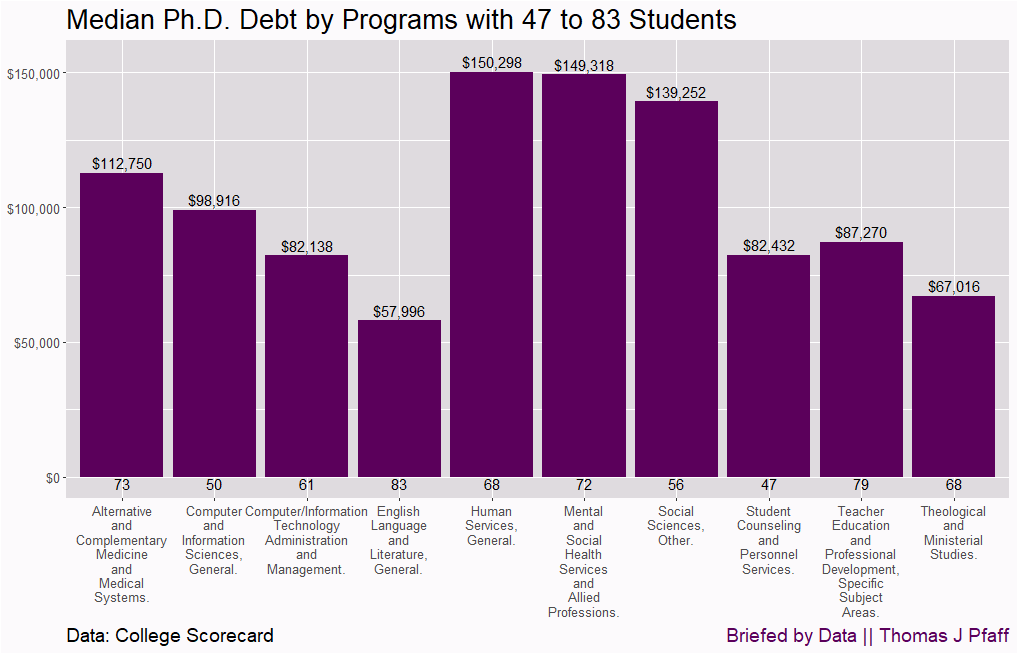

Ph.D. programs with 47 to 83 students

These are the smaller programs. Again, most of these look extremely high to me. The lowest tuition is $57,996 for an English language and literature degree. I assume these are all faculty now, and depending on the college that hired them, this could be justifiable. On the other hand, a median of $150,298 for a Human Services Ph.D. seems questionable. What am I missing?

Ph.D. programs below 44 students

The tiny programs are in Figure 5. Again, some of these appear to be quite high. Sure, pharmacy may pay well, but with a median debt of $283,764 for 25 students? What exactly does one accomplish with the Liberal Arts General Studies Program to justify $190,628 in average debt? A similar argument applies to the Religious Studies program.

Final thoughts

Is there a PhD debt problem? Some of these data do not make sense to me, but does that indicate a problem? At the same time, folks will pay $60,000 for a car or truck, which also doesn't make sense to me. I think as long as students are willing to pay the price, the market is doing its job, and the government shouldn't bail them out. What am I missing here? Which programs do you believe are worthwhile, and which are not so much? If someone took out this debt and it didn’t pay off, what should society do, if anything?

In the master’s degree edition, I noted this quote from the Guardian (10/8/2023), which is the first paragraph:

I owe $120,000 to the American government, which I accrued chasing the American dream. Yes, I am yet another person who was taken in by the predatory lending practices of student loans.

I’m assuming this includes all of the college debt this person has. This is not unusual, and given what is said in the Guardian article, it may well pay off. I don’t think the loan practices are “predatory.”

Please share and like

Please help me find readers by forwarding this article to your friends (and even those who aren't your friends), sharing this post on social media, and clicking like. If you're on Twitter, you can find me at BriefedByData. If you have any article ideas, feedback, or other views, please email me at briefedbydata@substack.com.

Thank you

In a crowded media market, it's hard to get people to read your work. I have a long way to go, and I want to say thank you to everyone who has helped me find and attract subscribers.

Disagreeing and using comments

I'd rather know the truth and understand the world than always be right. I'm not writing to upset or antagonize anyone on purpose, though I guess that could happen. I welcome dissent and disagreement in the comments. We all should be forced to articulate our viewpoints and change our minds when we need to, but we should also know that we can respectfully disagree and move on. So, if you think something said is wrong or misrepresented, then please share your viewpoint in the comments.